“You must gain control over your money,

or the lack of it will forever control you.”

— Dave Ramsey

What we are going for is ease and maximum effect. Finances should be a well oiled machine for funding your life.

1. Foundation

Begin with the system. Do not focus on the process just yet.

Open your accounts, these are all you will need at this point:

Two Checking Accounts

Most banks will work. Do not worry about interest rates. Just make sure they do not have any fees or minimums. Beyond that, it is all focused on customer service and needs for in-person usage.

Ideally both accounts would be with the same bank for you to make realtime transfers between the two accounts. The banks listed below all allow for a system like this where you have two separate checking accounts with two separate debit cards

For a top-tier account, we want no fees or minimums, minimal foreign transaction fees, free ATM withdrawals, cash deposits if using cash

Several very good options to consider:

Schwab Bank (my personal choice)

Ally Bank (if cash deposits are necessary)

Fidelity (nearly identical to Schwab)

For additional options, reference this article for the best checking accounts.

The two checking accounts will be:

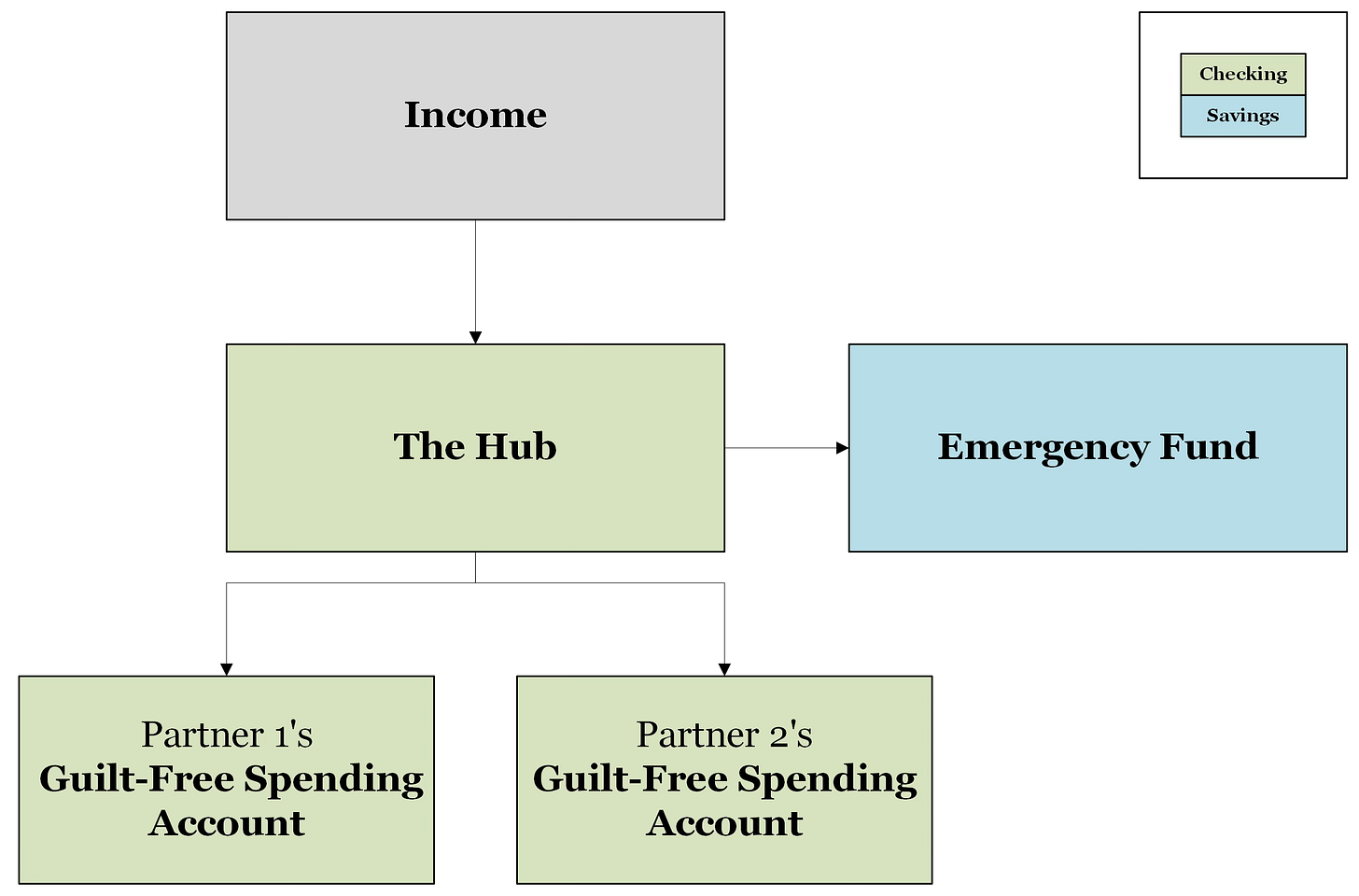

The Hub — This is where all your money flows in/out of. This is not for spending, but rather as a place for your money to move between.

Guilt-Free Spending — As we will talk about later, this is where you will be able to spend your money.

One Savings Account

Emergency Fund

Savings: Any High-Yield Savings Account (over 3%) that is at least FDIC-insured. Do not spend too much time chasing the best rates and switching savings accounts. The difference in profit is unbelievably minimal. Hypothetically, let’s say you have $10,000.00 in your emergency fund. Even a difference of 0.50% (which is a rather large difference when looking at the rates of these savings accounts) only means that you earn an extra $4.17 every month. The solution is to find a bank that historically has had high rates (over 3%) and go with them. This account is solely to ensure your emergency fund rises with inflation, not to generate wealth.

Several top-tier options to consider:

Marcus by Goldman Sachs (my personal choice)

For additional options, reference this article for the best savings accounts.

One Credit Card

“I have never met a millionaire who said they made their fortune from credit card points.” - Dave Ramsey

I just think credit is very foundational and needs to be highlighted here

Age 18 get a secured credit card, put one subscription on there and that is it. Auto-pay this from the Hub account. Never carry a balance and never miss a payment.

Goal is 740/760 and above. This opens you up to the best interest rates when it comes time to get a loan. Mortgage will likely be the largest purchase you make, so you better be getting the best interest rate on it

Paying on credit you pay 15-20% more, removes any benefits from points. Some people are able to balance this and use them like debit cards, but the statistics show that’s not the majority.

Break down the score here a little bit, but don’t overwhelm.

The System

I think I want a diagram here outlining where money actually flows from account to account. Guilt free spending account maybe add in here too since it’ll be part of the larger system.

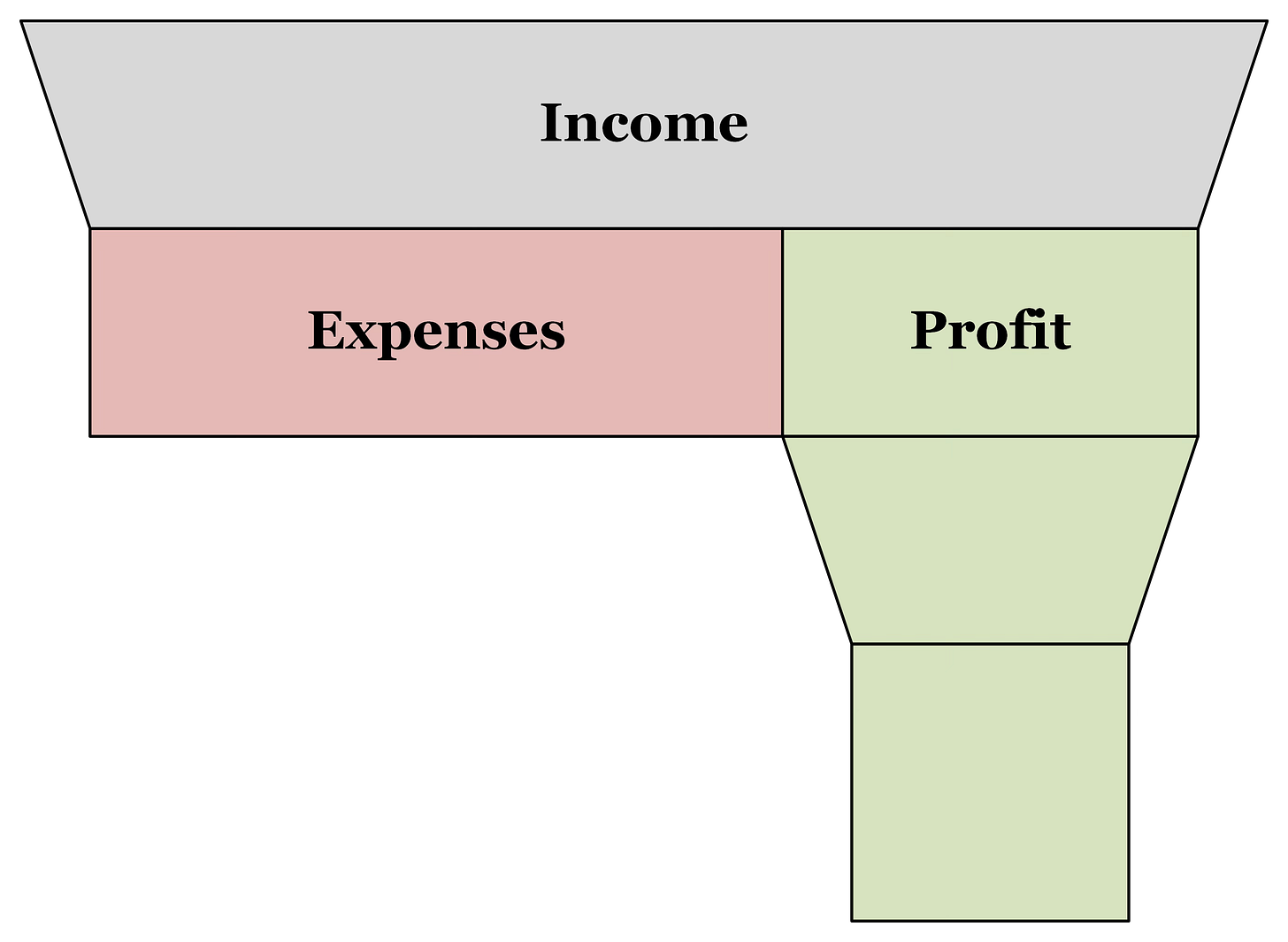

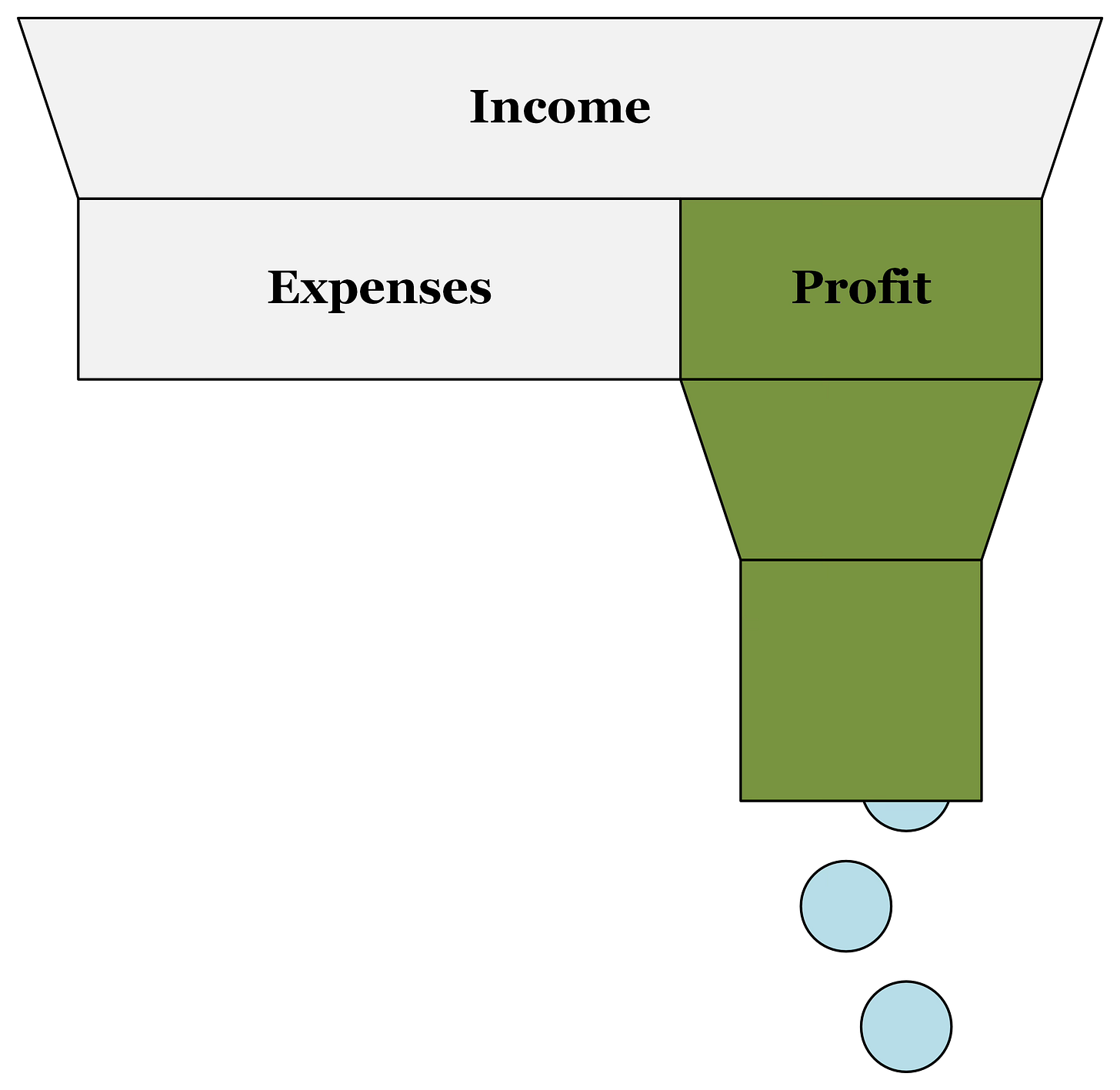

2. Profit

Profit essentials

Live below your means

Calculate your numbers (CSP ramit)

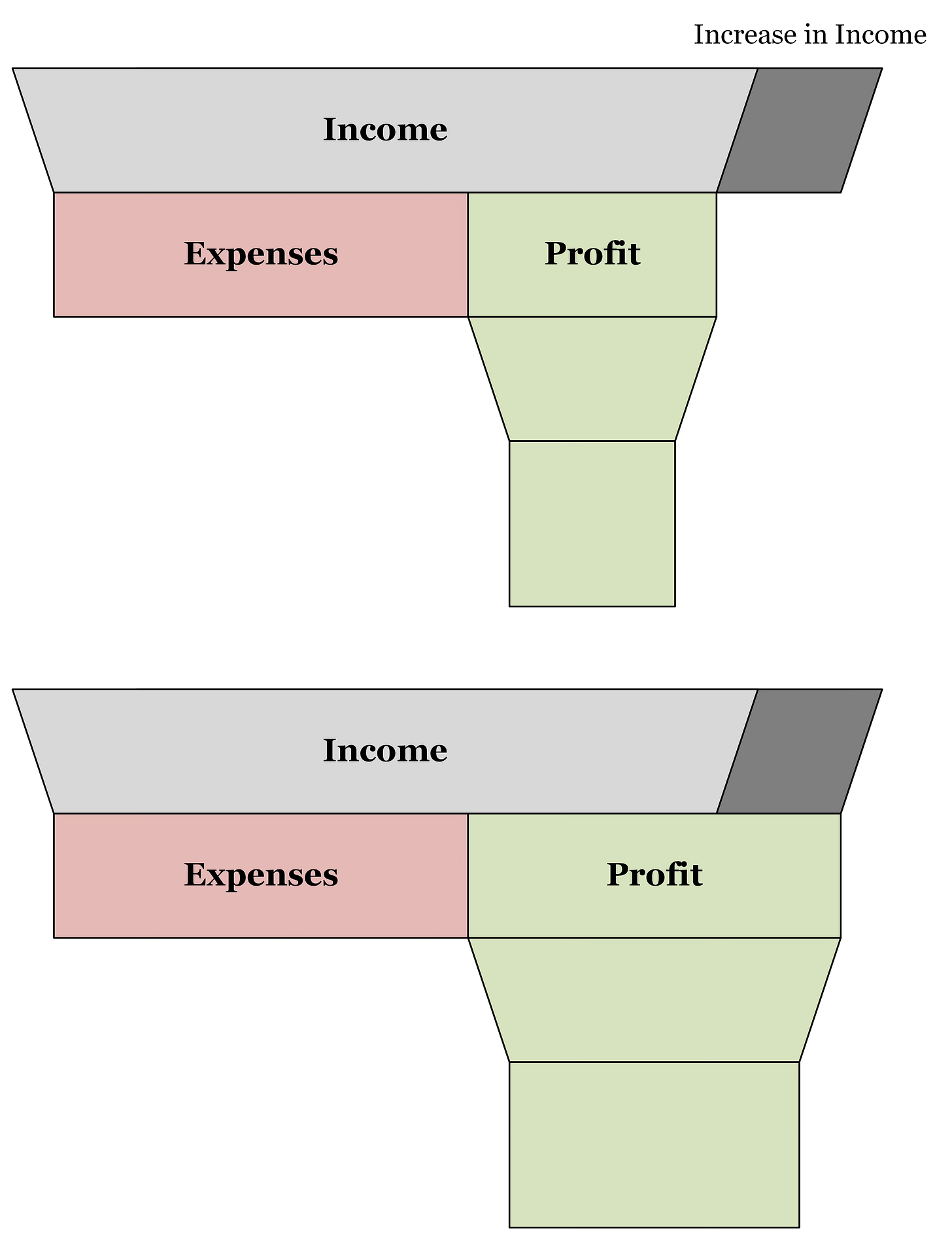

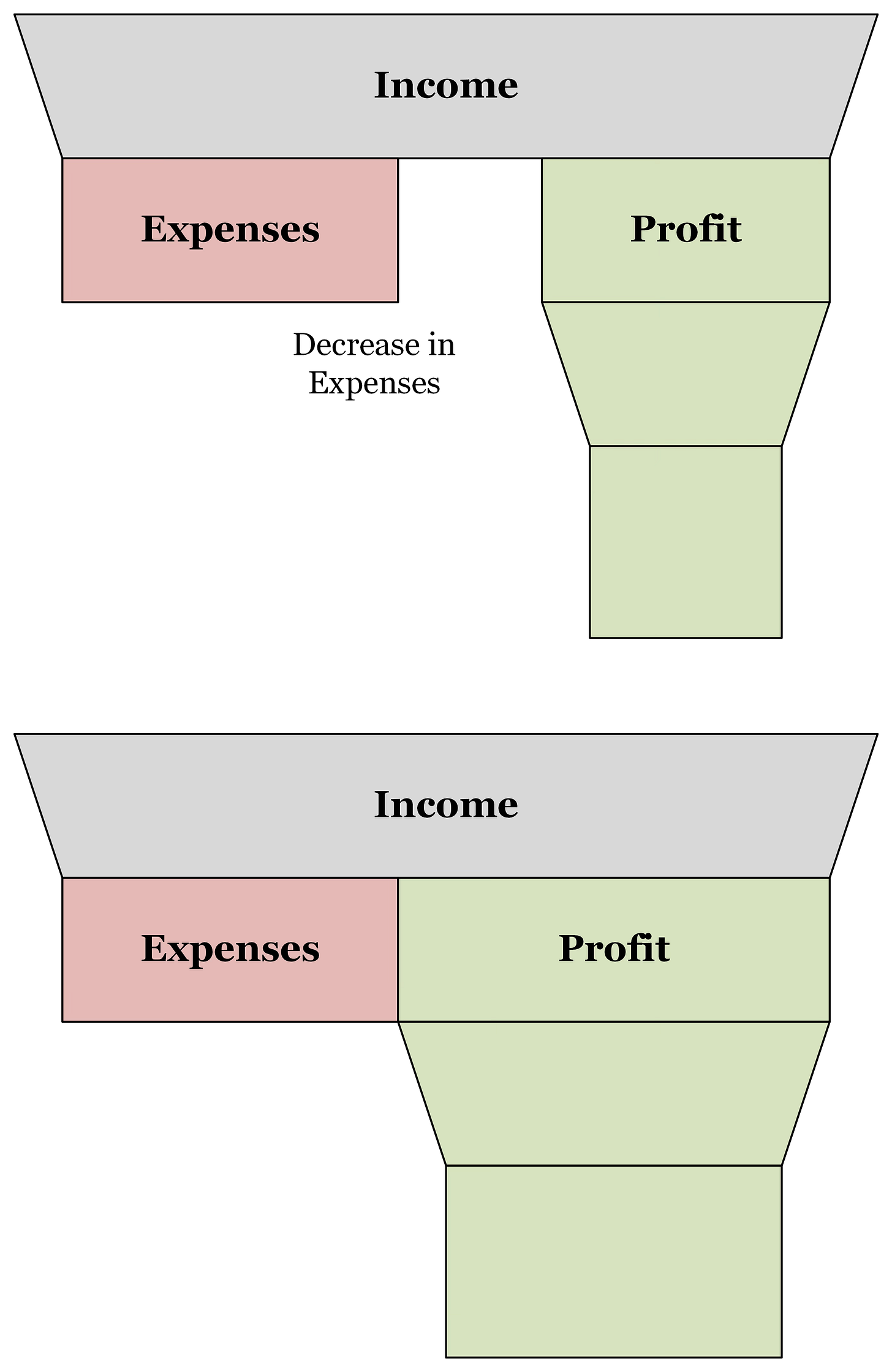

Only two ways to increase profit:

(1) Increase in income

Side gigs

Raise

Job change

Other sources of income

(2) Decrease in expenses

Spreadsheets

Apps (input some here)

Conscious spending plan (ramit) input link here

Spend aligned with values (Vicki Robin): every dollar is life energy

Use money to buy time & memories (Bill Perkins): fund experiences on purpose

“If you can’t buy it twice, you can’t afford it,” (Jay-Z lmao)

Include something here on automation. Automate the basics (Sethi): money moves itself; willpower is for life, not bills.

“Stop agonizing over $3 decisions while ignoring $30,000 ones. Focus on the Big Wins—the five to ten things that get you disproportionate results, including automating your savings, finding a job you love, and negotiating your salary.” - ramit Sethi

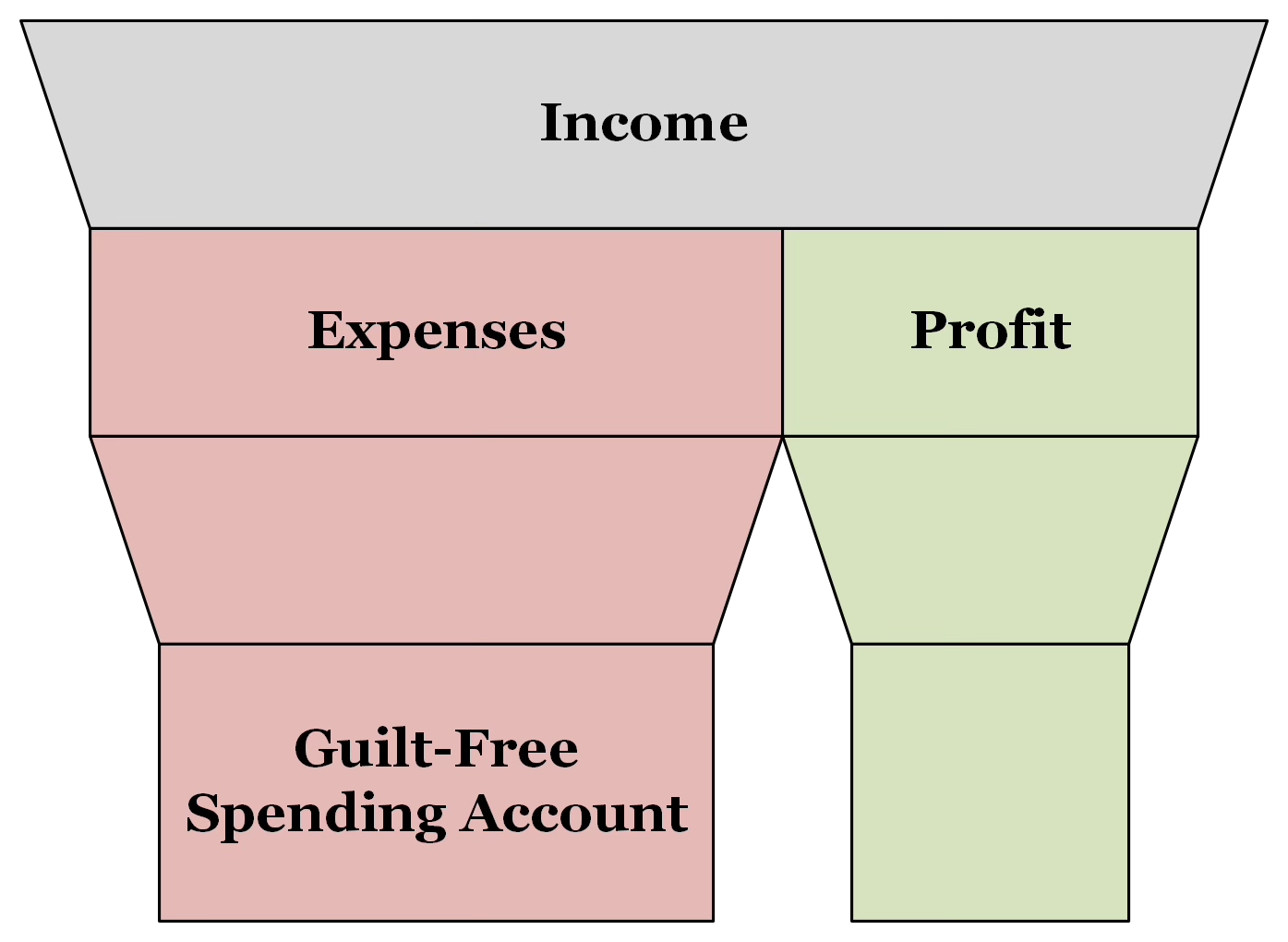

“Guilt-Free Spending” Account

One of the best ways to decrease expenses is to have a separate “guilt-free spending” account. This has a certain amount of money deposited into it each paycheck to act as your spending money. This acts as cash and when you run out, you know you’ve hit your limit and need to wait until the next deposit. In cases like these, I keep a credit card handy (Schwab for me) but then I know from that point on that every spend on that credit card is over-budget spending, psychologically helping me limit my spend.

One of the benefits of this is that it is purely guilt-free when you have it in your account. This is your spending account that you can buy whatever you want.

This can be in a different bank or the same bank. The banks listed above all allow for a system like this where you have two separate checking accounts with two separate debit cards

In practice, this is how our system will work going forward:

3. Building Financial Security

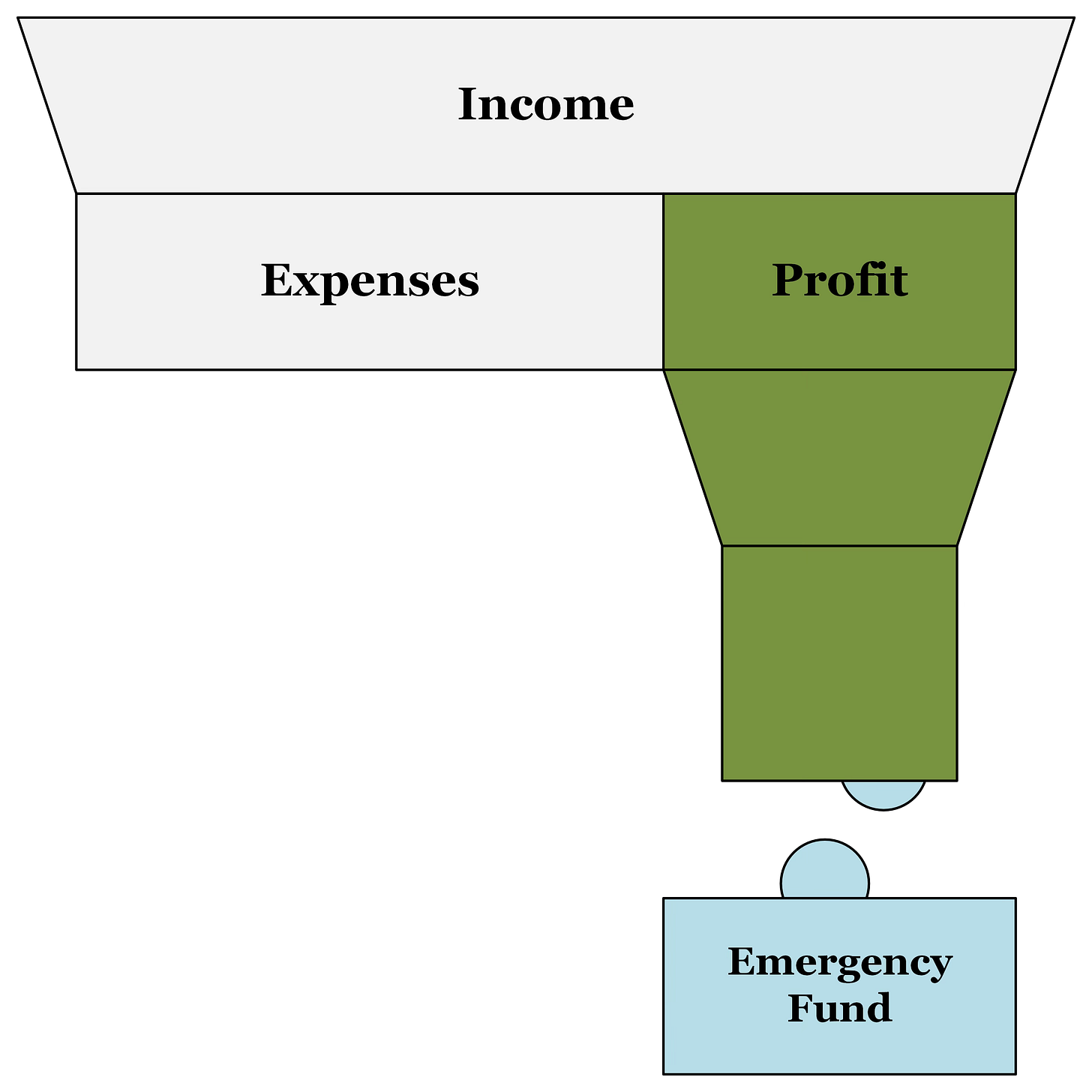

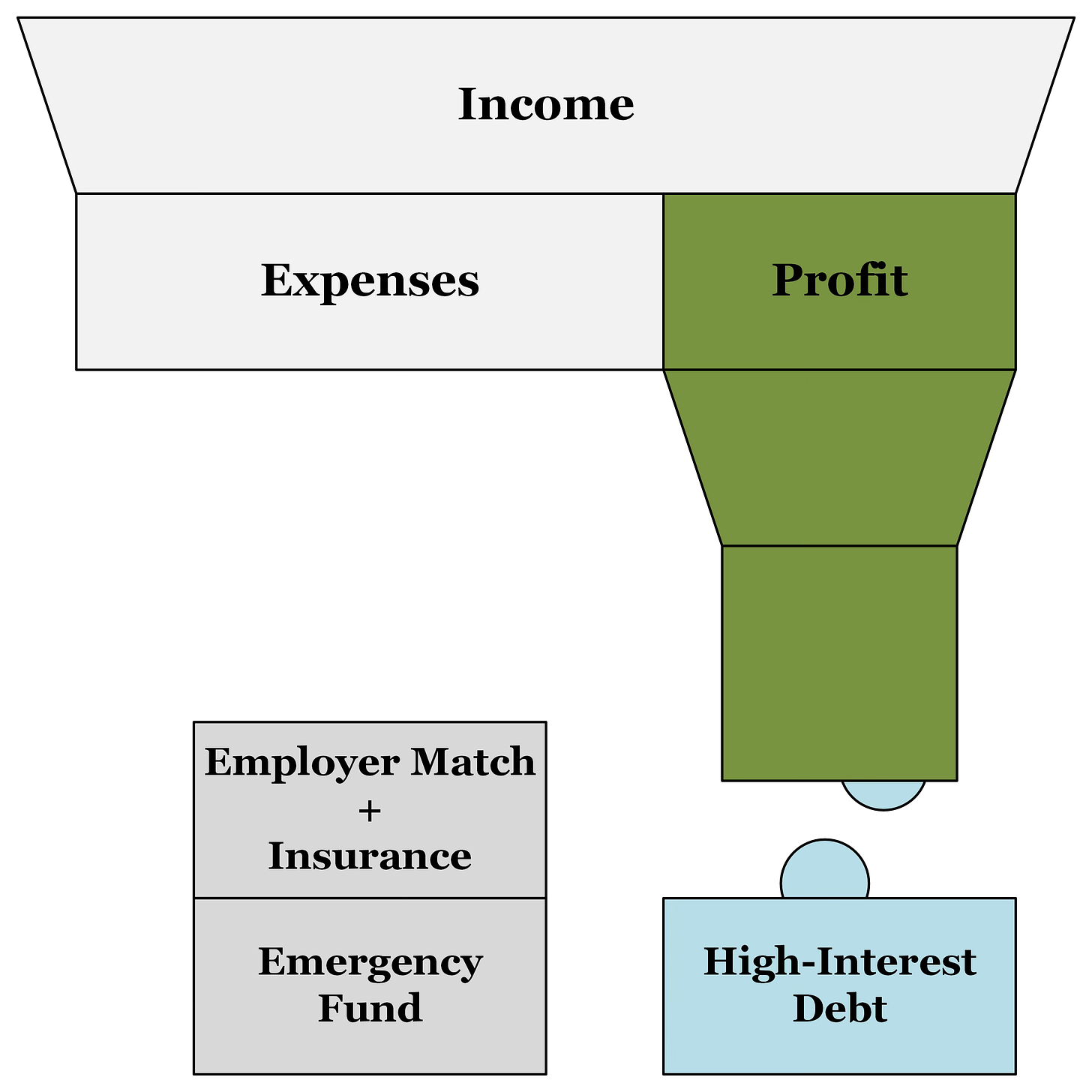

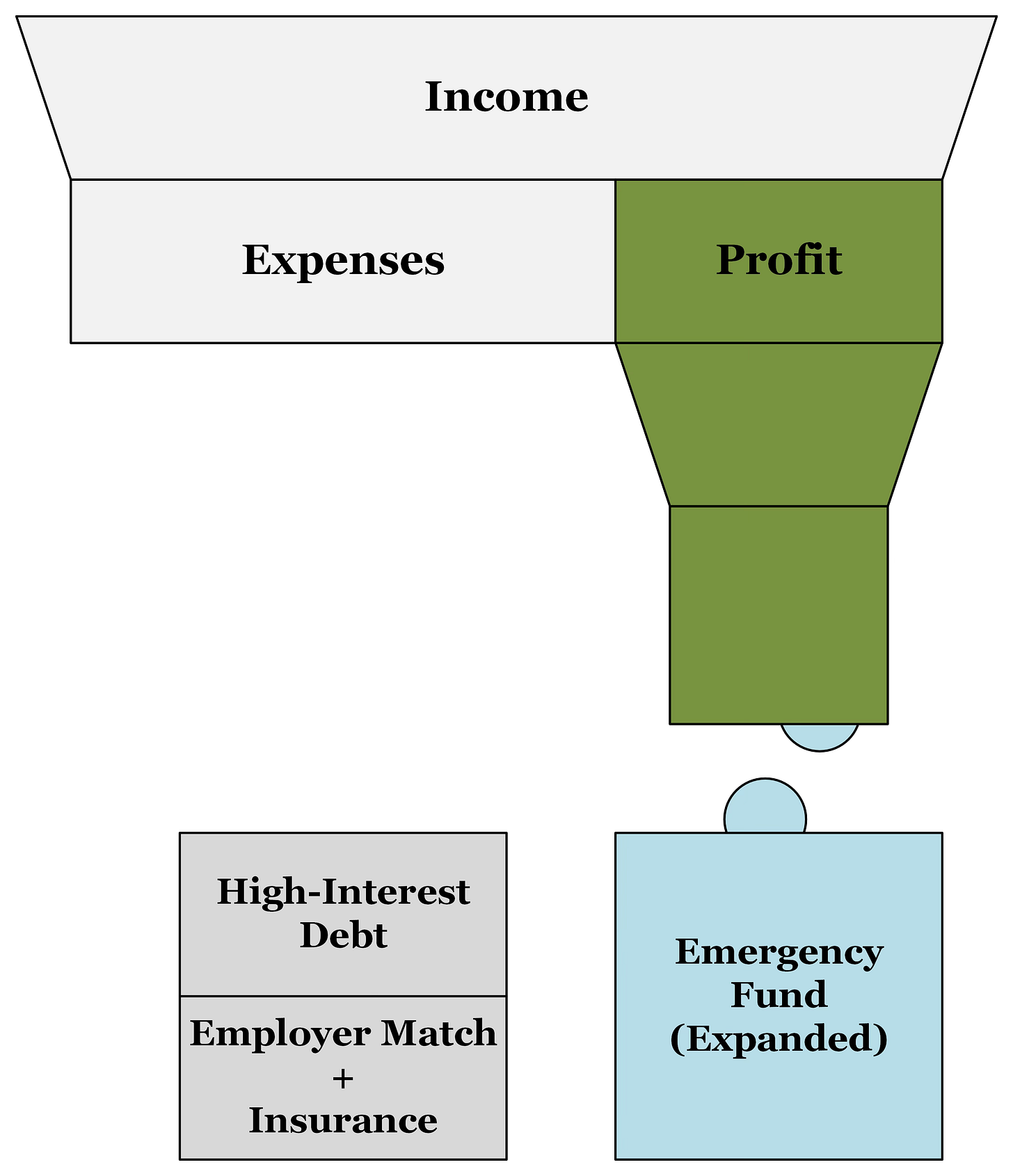

From now on, we will be focusing on where to put your profit each month.

We will focus on putting buckets under this pipe and filling them up as we go along.

3A. Emergency Fund

Amount: $1,000 or 1 month’s worth of expenses

The original $1,000 hasn’t been adjusted for inflation since the 1990s. Adjusted for 2025 costs, this should be approximately $1,600-$2,500 minimum. However, modern emergencies often exceed this amount.

Only 41% of Americans would pay for an unexpected $1,000 expense (like a car repair or ER visit) using their savings.

https://www.bankrate.com/banking/savings/how-to-rebuild-emergency-savings/#:~:text=Less%20than%20half%20of%20Americans,June%202024%2C%20the%20survey%20found.

This means 59% of Americans would likely struggle to cover a $1,000 bill. They reported they would instead use a credit card and pay it off over time (25%), borrow from family/friends (13%), or reduce spending on other essentials (13%).

$1000 or 1 month’s worth of expenses

Expert Recommendation:

Minimum: One month of essential expenses or $1,000, whichever is higher

Target: Enough to cover your highest insurance deductible plus $1,000

Location: High-yield savings account

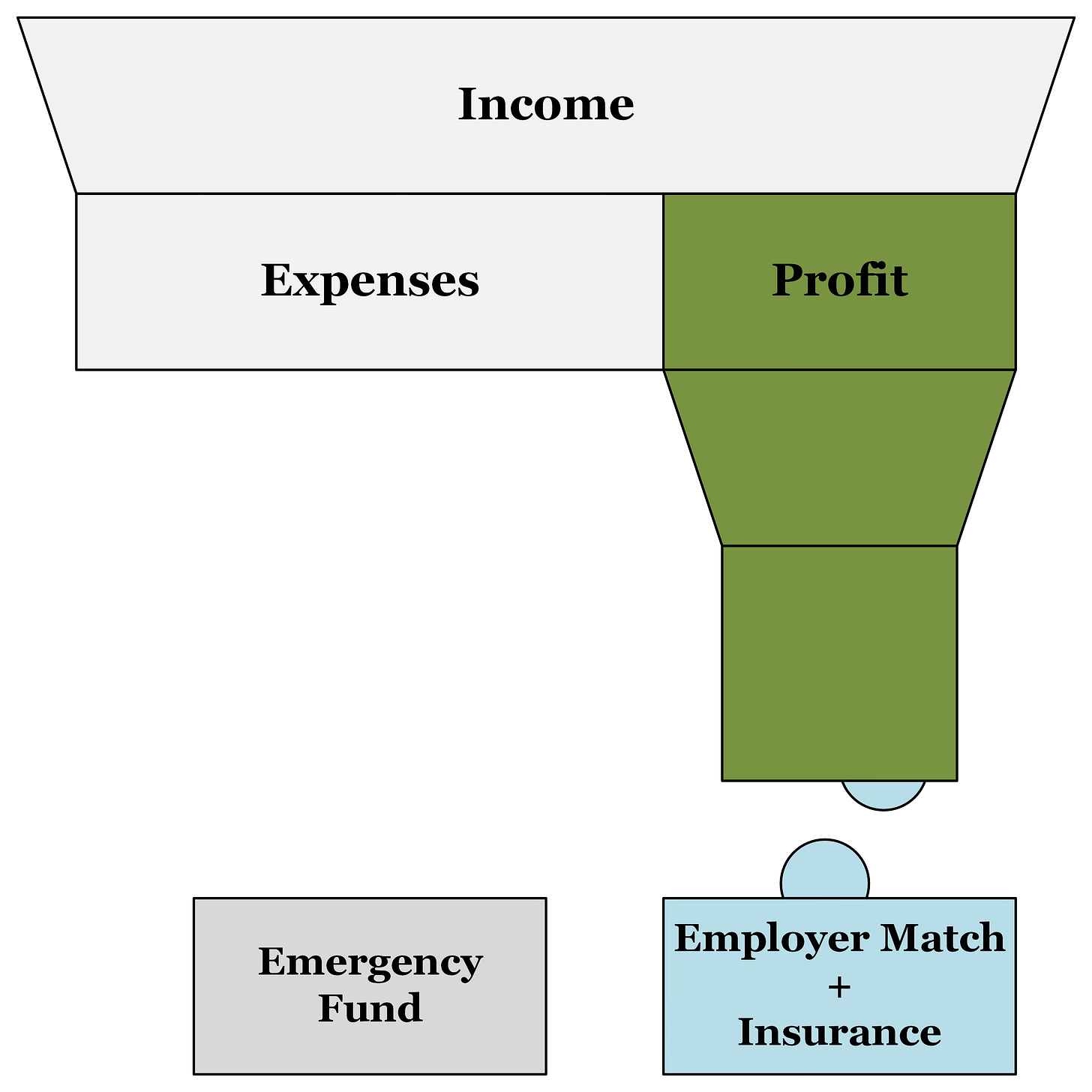

3B. Employer Match + Insurance

Get employer 401(k) match + basic insurance coverage + HSA match

This addresses the major flaw of completely avoiding retirement savings during debt payoff. This is “free money” that shouldn’t be left on the table.

If available:

401(k) — Contribute enough to get full employer match (typically 3-6% of salary), and nothing more. If no match / no contributions needed for their full contribution, then contribute $0.

HSA — Contribute enough to get full employer match, and nothing more. If no match / no contributions needed for their full contribution, then contribute $0.

Ensure adequate health, disability, and life insurance coverage. Make sure you can cover the deductible.

3C. Pay Off High-Interest Debt

Use the Debt Avalanche method with psychological modifications

Depending on the interest rate:

> 8% — Put your money here to pay off as much as possible

5-8% — Decide where your cutoff point is, this is where preferences come into play. Statistically, the stock market returns around 6.5-7% annually (adjusted for inflation), so mathematically that is the cutoff point where investing is more profitable (I use 7% as my cutoff, anything below this I invest instead, anything at or above, I pay off). However, if there is a strong psychological push to clear as much debt as possible, then do so down to 5%.

< 5% — Only pay minimum payments at this point, the opportunity cost of investments outweigh this low of interest. There are more pressing focuses right now. Paying these down will come later once you’ve earned it.

Optimized Approach:

Research consistently shows the debt avalanche (highest interest rate first) is mathematically superior. However, the debt snowball has psychological benefits for some people.

Primary Strategy: Pay highest interest rate debts first (mathematically optimal, Avalanche method)

Psychological Modification: If you have more than 5 debts, pay off 1-2 smallest balances first to build momentum, then switch to avalanche method

Student Loans: Consider income-driven repayment for federal loans if pursuing loan forgiveness

3D. Complete Emergency Fund

3-6 months of expenses, with strategic modifications

The traditional 3-6 months remains valid, but modern implementation should be more sophisticated.

Expert Recommendations:

Stable Employment: 3-6 months of essential expenses, including dual income households

Variable Income: 6-12 months of expenses, depending on expectation

This is a personal decision, but build up somewhere on this spectrum to have a strong financial foundation before moving to investing.

In HYSA >3% (inflation rate, protected)

3E. Financial Security

By this point, we have reached a healthy level, resulting in:

Savings of 3-12 months of expenses (emergency fund) in a HYSA beating inflation,

Maximized free company investment through a 401(k) match (but contributing nothing more),

Insurance coverage for the rainy day when we need it, and finally,

No high-interest debt

Now we are able to focus on multiple priorities at once, rather than funneling all discretionary funds into one specific path.

4. Wealth Generation

Now we can build out our continuous system after we have our financial security built out.

Some philosophies to bake out here for this section

This is where it really does become personalized. Some want to retire early with a small amount of money, some want to retire late with a larger sum… and everywhere in between

Rich life mini course (https://www.iwillteachyoutoberich.com/design-your-rich-life/)

Housel + Sahil Bloom: True wealth is about freedom and control over time, not material possessions.

Write an investment policy statement

Sethi (money for couples) + Housel: Personal experiences deeply influence how one thinks about money—no one is crazy, just shaped by their own story.

Housel: Enough is a moving target, know when enough is enough. Stop “keeping up with the Jones’s”

(Add in the other accounts we now need)

System:

Any 401(k) contributions come out to meet the employer match, but nothing more

Remaining salary comes into Hub checking account

Now we split up

Rent and other fixed costs come out of this account, automatically.

Certain percentage goes to guilt free spending (spending account), this is your way of using an envelope of cash, this is your spend limit, but you can spend this however you’d like, until it runs out and fills up the next time you get paid.

The remainder is your free cash. The following steps decide where this money goes.

(Input diagram here)

Clearly show the automation and guilt free spending etc

Working alongside one another are two areas:

Retirement Accounts, maintain a percentage of your discretionary funds going towards one of these tax-advantaged retirement accounts, automatically

Savings

Now as we’ll see below, the savings can be put anywhere. Some of the options include:

- Children’s education fund (if applicable)

- Paying off low-interest debt

- Advanced wealth building

Depending on your values and your current focus, you can flex different options here for where to spend your money.

4A. Maximize Tax-Advantaged Retirement Savings

15-25% total retirement savings rate

Among people with a total net worth of at least $1 million, 97.7% of them also qualify as “retirement millionaires.” This means that for nearly every millionaire, their retirement accounts are the core engine of their wealth.

https://www.empower.com/the-currency/life/becoming-the-millionaire-next-door-news#:~:text=Change%20in%20average%20balances%20–%20accounts,as%20of%20September%2030%2C%202025.

Priority Order:

HSA maximum (if eligible) - triple tax advantage (talk about it here)

Do you expect to be in a higher tax bracket when withdrawing?

Yes → Max-out Roth IRA first, then max-out 401(k) (input something here on turning 401k into Roth 401k contributions early)

No → Max-out Traditional 401(k) first, then max-out Roth IRA

Consider Backdoor Roth and Mega Backdoor Roth, if at high income levels (>$150k). If you are self-employed or do not have a 401(k) available to you, a Solo 401(k) or SEP IRA can serve the same role.

Investment Strategy:

Asset Allocation: Age-appropriate mix (e.g., 80/20 stocks/bonds for 20s-30s).

Fund Selection: Low-cost index funds (expense ratios under 0.1%)

Diversification: Total stock market and international index funds

The best solution to these descriptors are Target Date Index Funds. These will be automatically managed (low expense ratio), age-appropriate (adjusts as you move towards retirement), and are broad indexes (covering the whole stock market typically).

Own the market (Bogle/Collins/Graham/Malkiel): one low-cost total-market index in the Roth; hold forever. Time in the market beats timing the market. Dollar cost averaging.

I would recommend using one of the following for your target date index funds:

Fidelity (2065 retirement = FFIJX)

Vanguard (2065 retirement = VLXVX) $1000 minimum though

Schwab (2065 retirement = SWYOX)

All 3 companies are going to return roughly the same amount, and are all proven to be great companies to keep your money in.

I went with Schwab SWYOX due to its asset distribution (more stocks early, continuing to optimize through retirement vs the others than stay steady and end at retirement). I also switched the rest of my banking needs to also be Schwab to consolidate my accounts. Schwab has an incredible ecosystem for investing, checking, and even some good options for credit cards through Amex.

4B. Remainder of Profit

There are several levers you can pull here. If you have kids, you can fund their future (education accounts). If you want to get rid of all debt, you can focus on that. If you want to build your wealth more, you

Children’s Education Funding (If Applicable)

Strategic approach balancing retirement and education goals

Guidelines:

Only after securing your own retirement

529 plans for tax advantages

Consider that children have more financing options than retirees

Pay Off Low-Interest Debt (Including Mortgage)

Mathematical vs. psychological decision. This step receives the most criticism from experts due to opportunity cost.

Optimized Approach:

Interest Rate Test: Only pay off debt below 5% interest if it provides psychological peace of mind

Consider: Tax implications of mortgage interest deduction

Alternative: Invest the difference in tax-advantaged accounts if debt interest rate is below expected investment returns

Advanced Wealth Building

The Money Guy’s “hyper-accumulation” phase.

Strategies:

Taxable investing in low-cost index funds

Real estate investment (if appropriate for your situation)

Tax-loss harvesting for taxable accounts

Estate planning documents and strategies

Philanthropy

Build wealth and give generously

Input quotes from Gospel of Wealth — “The man who dies leaving behind him millions of available wealth, which was his to administer during his life, will pass away ‘unwept, unhonored, and unsung‘ ... Of such as these the public verdict will then be: The man who dies rich dies disgraced.”

Same with Peter singer and macaskill

Die with zero - bill Perkins

Conveniently, charitable giving is very tax-efficient

Do good on a schedule (Toby Ord/Ben Todd): giving is built in.

Donating, charity